Mon, Apr 28

3 min 30 sec

What Is Indices Trading and What Are the Best Strategies for Trading Indices?

Summary

Aperiam minus corporis. Ex aut fugiat sed rem quia nesciunt. Voluptas est est fugiat ratione perferendis qui quod in sint. Reiciendis explicabo quae exercitationem alias odit cupiditate aut vitae. Dolore qui atque tenetur cupiditate ea minima quas laudantium temporibus.

More Articles:

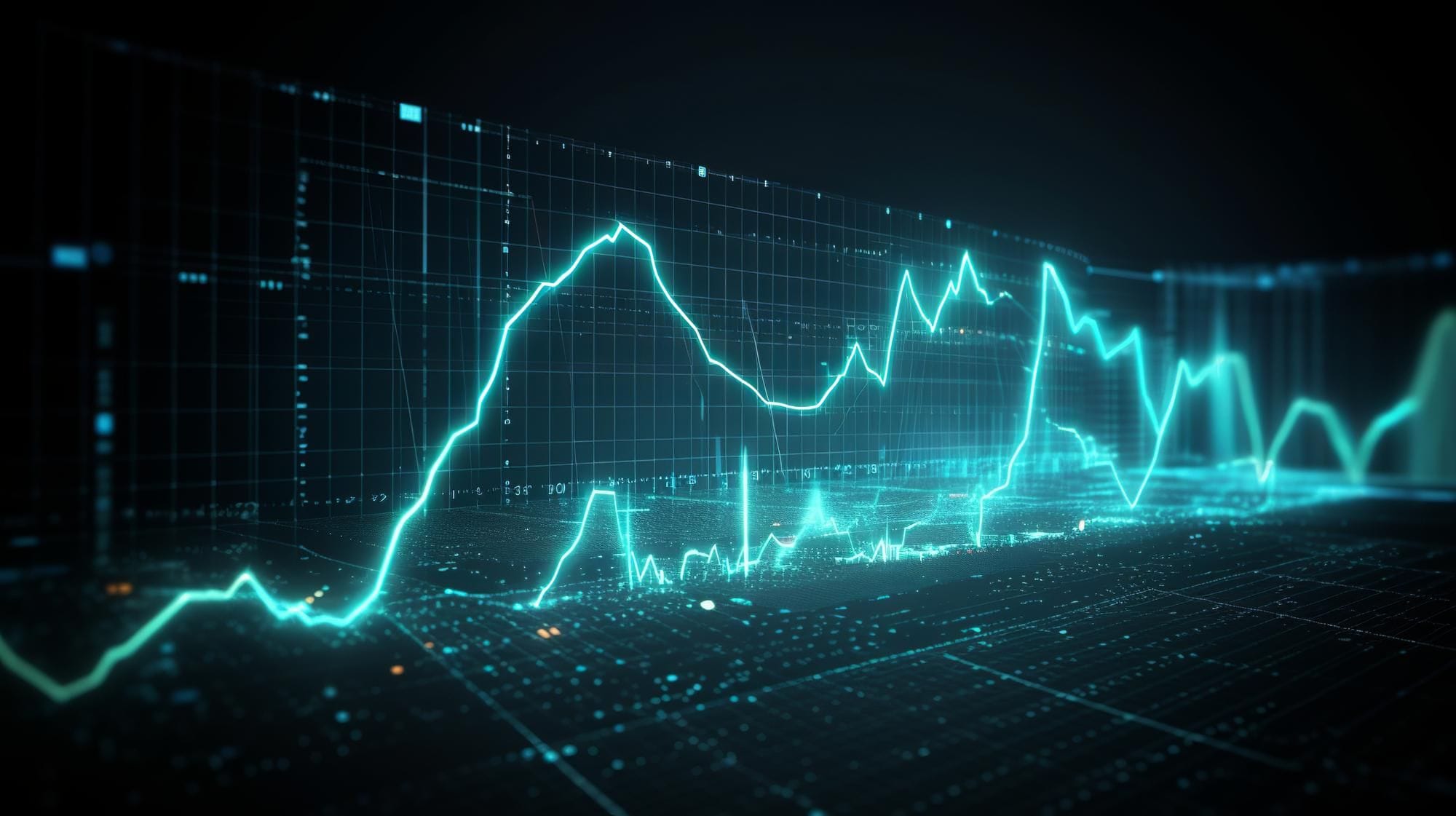

Indices trading represents a dynamic aspect of the financial markets, offering both diversification and strategic gains. As global markets become increasingly complex, understanding indices trading and leveraging the right trading platform can significantly impact your success.

This comprehensive guide explores what indices trading entails, its benefits, and effective strategies to optimize your trading performance.

What Is Indices Trading and What Are the Best Strategies for Trading Indices?

Indices trading involves buying and selling financial indices, which are aggregated collections of stocks or other securities representing specific market segments. These indices mirror the performance of a market sector or the broader market itself. For instance, the S&P 500 index includes 500 of the largest publicly traded companies in the United States, while the FTSE 100 index tracks the top 100 companies listed on the London Stock Exchange.

Indices provide a snapshot of market performance by reflecting the collective value of their constituent securities. When you trade indices, you speculate on the overall movement of a market segment or the entire market, rather than focusing on individual stocks. This method offers diversified exposure, reducing the risks typically associated with single-stock investments.

For a more in-depth understanding of indices trading and its benefits, visit our detailed page on indices trading at Spectra Global.

The Benefits of Trading Indices

1.Diversification

One of the primary advantages of indices trading is the ability to achieve diversification. Investing in an index means you are effectively investing in a broad range of stocks or assets within that index. This diversification helps mitigate the risks tied to individual securities. As the performance of an index reflects the aggregate performance of its constituent stocks, it is less susceptible to the volatility of any single stock.

2.Lower Volatility

Indices generally exhibit lower volatility compared to individual stocks. The performance of an index is a composite of the performance of multiple stocks, which smooths out the volatility associated with any single stock. This results in a more stable trading experience, which can be advantageous for both short-term and long-term traders. Lower volatility can also make indices a more predictable investment, helping traders make more informed decisions.

3.Market Insights

Indices provide valuable insights into overall market sentiment and economic trends. By analyzing index movements, traders can gauge the health of a specific market sector or the broader economy. This information is crucial for making well-informed trading decisions and adapting strategies according to current market conditions. Indices can also help traders identify emerging trends and market shifts, offering a competitive edge in trading.

4.Cost-Effective

Trading indices often presents a more affordable alternative to trading individual stocks. Since trading an index typically involves fewer transactions, it results in lower trading fees and commissions. Additionally, trading indices eliminates the need for extensive research and monitoring of individual stocks, further reducing costs. This cost-effectiveness makes indices trading accessible to a broader range of investors and traders.

Aperiam minus corporis. Ex aut fugiat sed rem quia nesciunt. Voluptas est est fugiat ratione perferendis qui quod in sint. Reiciendis explicabo quae exercitationem alias odit cupiditate aut vitae.

“First & Last Name”

More Articles:

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates — straight to your inbox.